To get the most out of Civil Pro’s Cost Management and Reporting modules, it is important to understand how they all fit together. The Cost Management and Reporting system includes:

While these registers are useful in their own right, it is the relationships between them that make the Cost Management system so powerful. To understand these relationships, this topic describes some concepts used to connect information. These include:

- Reporting Periods – reporting periods tie together information into discrete collections based on the time a cost is incurred or revenue earned. This supports profit and cashflow reporting, as well as reconciliations

- Invoice Reconciliation – invoice reconciliation allows the validation of requests for payment from Suppliers (invoices) against dockets and other records of goods and services made on the project on a daily basis

Contents

Reporting Periods

Reporting Periods are used for registers associated with project costs and revenues including:

Each of the records associated with these registers belongs to a specific reporting period which enables the comparison of cost vs. revenue within the reporting period. To create a new reporting period click on the New Reporting Period button in the bottom toolbar of any of the the associated registers and enter the information as prompted.

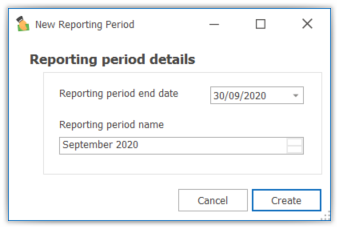

New reporting period dialog

When creating a new reporting period, the information required depends on the location from which the new reporting period was selected. This is because these sections are specific to the creation of a Progress Claim and can be implemented later by using the Rebuild Claim option from the Progress Claim Ribbon Menu.

- Reporting Period End Date – the last date for which Invoices, Daycosts or works claimed are incurred for this reporting period. Selecting this date will automatically update the Claim Cutoff date and the Reporting period name. The latter defaults to a text description of month/year of the selected end date

- Claim Cutoff Date – the last date on which works completed on site can be included in the progress claim

- Reporting Period Name – A descriptor for the new reporting period

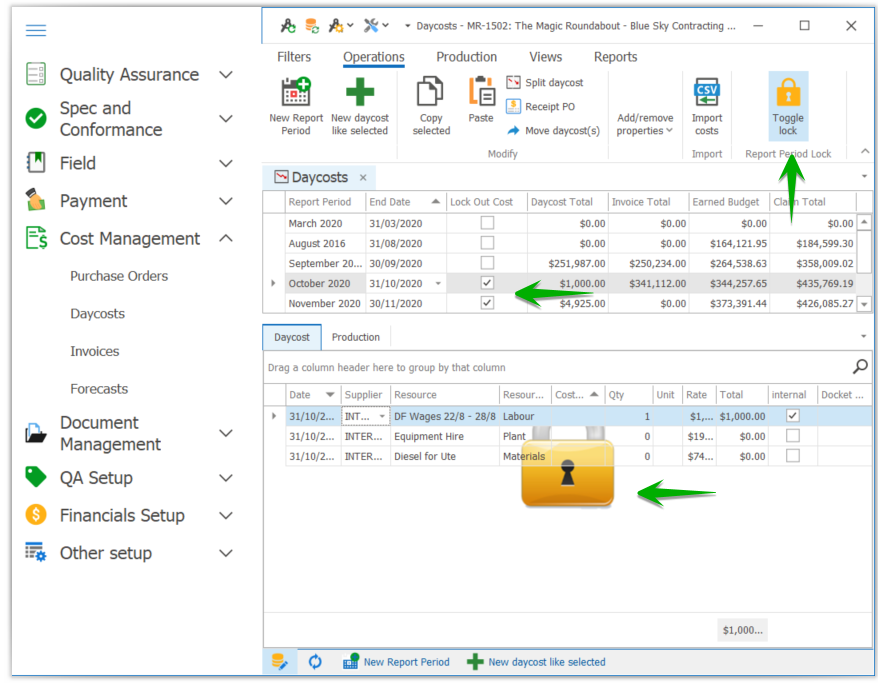

Report period locking

Locking records for each reporting period is controlled independently for the Invoice, Daycost and Progress Claim registers, but all locking behaves in essentially the same way. All previous report periods are locked for changes to the Invoice, Daycost and Forecasts immediately upon the creation of a new reporting period.

Visual cues

When a register is locked for a report period, there are 2 visual cues;

- A large lock icon will be visible behind the register.

- The relevant column in the report period grid will be checked.

Unlocking a reporting period

To unlock a reporting period (and to lock it again), select the Toggle [type] Lock from the Register’s Ribbon Menu.

Invoice reconciliation

Civil Pro’s invoice reconciliation process provides a mechanism for validating a Supplier’s invoices against the daily records of Resources and services used on site. This is achieved by associating each Invoice with one or more Daycost entries. The preferred method for reconciling Invoices is to use the Invoice reconciliation processes built into the Invoice Register, but Invoices can also be directly associated with Daycosts using the Invoice reconciliation views of the Daycost Register and Daycost Register functions specifically for this purpose.

When Civil Pro reports its costs, it uses the Daycost register NOT the Invoices. The Invoice totals are calculated for the purposes of Daycost validation, but are not the primary method of identifying project costs. This is because:

- After Invoice reconciliation, there should be no Invoices that are not covered by a Daycost entry.

- Daycosts are the easiest way to provide a detailed allocation of costs to different Cost Codes.

- Daycosts provide much more accurate information regarding timing of incurred costs allowing better matching with earned budget or revenue.

- Daycosts record costs for which an Invoice may not yet be received.

- Daycost data is more timely – often less than 1 day old whereas Invoice processing means these costs can easily take 45 days to identify from the day they were incurred.

In the reporting process, Daycosts are broken into several categories:

- Reconciled Daycosts – these are assigned to an Invoice

- Not Invoiced – Daycosts marked as ‘Not invoiced’ are Daycosts for which an Invoice is not expected, and so cannot be reconciled. These are usually internally company costs such as wages or distributions to related entities for the provision of resources (e.g. overheads)

- Accruals – Daycosts for which no Invoice has been received, but for which an Invoice is expected. All costs which have no Invoice, are not tagged as Not Invoiced and not specifically marked as No accrual are automatically accrued.

- Unaccrued Daycosts – these are Daycosts without an Invoice which would normally be accrued, but which aren’t because they are tagged No accrual. You may do this for costs you want to track, but you are fairly sure will not be Invoiced.

For information on the invoice reconciliation process, refer to the Invoices help topic.