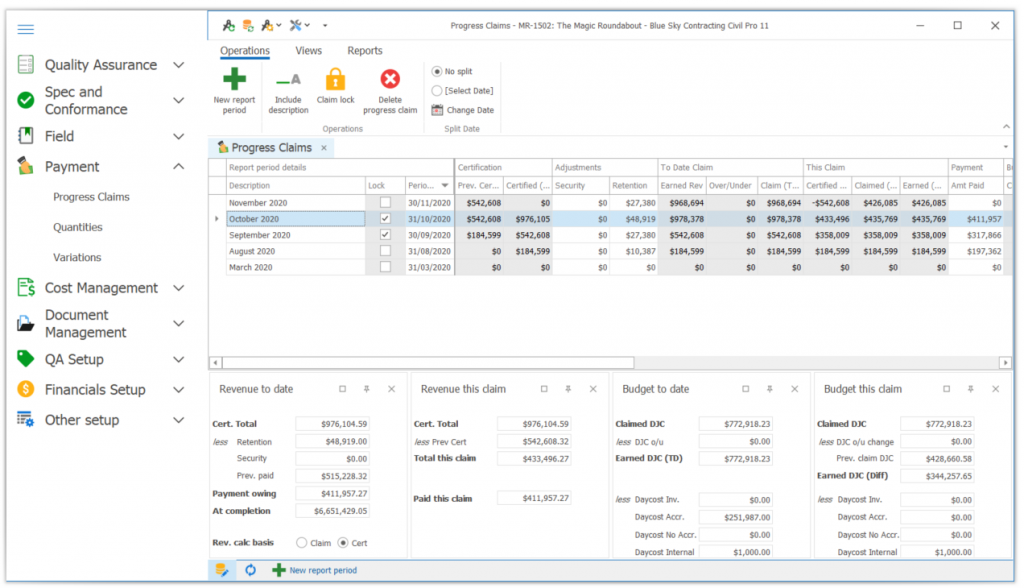

The Progress Claim register summarises not only each of the Progress Claims, but all of the reporting information for each report period. It is accessed from the Main Menu => Payment => Progress claims.

Contents

About the progress claim register

When you open the Progress Claim Register, each of the reporting periods for your project is shown in the grid, regardless of whether you have created a Progress Claim for it or not. This grid differs to many in Civil Pro in that it is usually wider than the available screen. The 3 columns to the left are fixed, but additional columns are viewed by scrolling to the right. Even though there are many more columns, there are still many which remain hidden. These can be accessed using the Views option of the Context Menu or the column chooser as per usual.

The panels at the bottom show key claim / budget / cost information for the selected report period.

Note: Civil Pro calculates the monies claimed for the current reporting period (This Claim) values as the Total Claim (To date) – Total Previous Claim (To date). Columns representing values for This Claim are identified by the suffix (Diff) in the column heading – the last 3 columns in the screenshot below are different columns.

Creating / accessing a progress claim

To see the Claim for any given reporting period, double click on it in the Grid. If the Claim exists, it will be displayed. If it does not, then you will be guided through the creation of the claim. For more information on managing individual Progress Claims, refer to the Progress Claim Details topic.

Alternatively select the report period and use the Show Claim Detail option in the Context Menu.

Directly updating security, retention and ‘paid this claim’

The majority of the information shown is calculated from other Registers or the Claim Detail, but the values for the following are directly edited in the Progress Claim Register:

- Security

- Retention

- Paid this claim

To update these values, Enable Editing and update them in the Grid or in the Summary Panels.

Note: You cannot edit a locked Claim

Pre-baked and custom views

Like most Civil Pro Registers, there is a lot more information than is first shown when the Claim Register is opened. The default view is simply the information that the majority of users will want to access most of the time, with the other information hidden. Civil Pro provides a collection of pre-baked views which automatically change which information is visible. These are accessed from the Context Menu.

The available views are:

- Standard – shows the revenue, budget, daycosts, invoice costs and profit both to date and for the current report period

- Revenue – shows the revenue both to date and for the current report period

- Budget – shows the budget, daycosts, invoice costs and profit both to date and for the current report period

- Minimal – columns for the certified value, security, retention, to date value and current claim (diff) value.

- Certified – columns for the previously certified, certified to date, claim to date, certified (diff) and claimed (diff) values

- Payment – columns for the previously certified amount, security, retention, earned revenue, claim to date, current claim value, payment owing and amount paid.

- Earned – columns for earned revenue, under/over claim, claim to date, certified (Diff) and Claimed (diff) values.

- At completion – columns for the previously certified, certified to date, claim to date, certified (diff), claimed (diff) values and claim / budget at completion

Value calculation guide

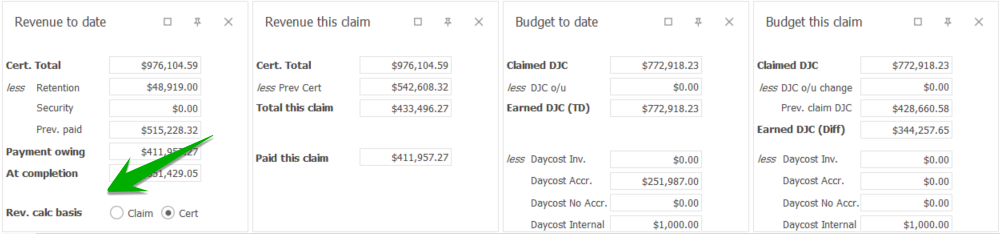

Note: The panels for Revenue to Date and Revenue this Claim show either claimed totals or certified totals depending on the option selected in the Rev. Calc Basis (highlighted green in below screenshot) option in the Revenue to Date panel.

The totals shown in the Progress Claim Register are calculated as follows:

Revenue to date

- Certified total 1 = (cert. qty * sellrate) for all Progress Claim Items

- Retention – directly entered

- Security – directly entered

- Previously Paid = (paid amount) for all previous Claims

- Payment Owing = Certified total – retention – security – previously paid

- At Completion = (qty at completion * sellrate) for all Progress Claim Items

1 Value changes to Claimed Amount when the Rev. calc basis is set to claim instead of cert.

Revenue this claim

- Certified total 1 = (cert. qty * sellrate) for all Progress Claim Items

- Previously certified = the certified total from the previous Claim

- Total this claim = certified total – previously certified

- Paid this claim – directly entered

1 Value changes to Claimed Amount when the Rev. calc basis is set to claim instead of cert.

Budget to date

- Claimed DJC = (claim qty * djc rate) for all Progress Claim Items

- DJC o/u = (O/U Qty * djc rate) for all Progress Claim Items

- Earned DJC (TD) = Claimed DJC – DJC o/u 1

- Daycost Inv = (all daycosts assigned to an invoice) 2

- Daycost Accrual = (all daycosts not assigned to an invoice and not marked internal or no accrual) 2

- Daycost No Accrual = (all daycosts not assigned to an invoice but marked no accrual) 2

- Daycost Internal = (all daycosts not assigned to an invoice but marked internal) 2

- Total daycost (TD) = Daycost Inv + Daycost Accrual + Daycost No Accrual + Daycost Internal

- DJC Profit (TD) = Earned DJC (TD) – Total daycost (TD)

1 This is also the same as (Actual Qty * djc rate) for all Progress Claim Items

2 for all reporting periods prior to and including the current period

Note: In Civil Pro, the certified quantity has absolutely no impact on the budget. The actual work completed is equal to the claim qty – overclaim qty and is completely independent of what the client certifies. The certified quantity is only relevant to the revenue. If the client certifies a quantity different to the claim quantity, and you find your actual quantity was in error, then adjust the actual quantity to suit.

Budget this claim

- Claimed DJC = (claim qty * djc rate) for all Progress Claim Items

- DJC o/u change = (O/U Qty * djc rate) for Progress Claim Items – difference to last claim

- Prev claim DJC = (claim qty * djc rate) for all Progress Claim Items in the previous claim

- Earned DJC (Diff) = Claimed DJC – DJC o/u change – DJC o/u change – Prev claim DJC

- Daycost Inv = (all daycosts assigned to an invoice in the current period)

- Daycost Accrual = (all daycosts not assigned to an invoice and not marked internal or no accrual in the current period) 2

- Daycost No Accrual = (all daycosts not assigned to an invoice but marked no accrual in the current period) 2

- Daycost Internal = (all daycosts not assigned to an invoice but marked internal in the current period) 2

- Total daycost (Diff) = Daycost Inv + Daycost Accrual + Daycost No Accrual + Daycost Internal

- DJC Profit (Diff) = Earned DJC (Diff) – Total daycost (Diff)

Claim register functions

Toggle Lock

Locks or unlocks the current Progress Claim. Locked Claims cannot be edited, even with editing enabled.

Note: When a new reporting period is created, all previous reporting periods are automatically locked out.

Show cents

A toggle switch indicating whether cents are shown for totals in the grid.

Reporting

Civil Pro provides many different reports for viewing your claim and financial performance, you should find a standard report for pretty much any purpose, but if you don’t – remember you can always create a custom report. Reports are accessed from the Reports tab in the Ribbon Menu.

Note: By default all claim presentation reports and the Lot Qty Report(Val) use the Claim Quantity to date. You can change these reports so that they use the certified quantity by using the Use certified qty in reports toggle switch in the Reports menu.

Claim presentation

- Progress Claim Cover – shows a one page summary for the Caim including the amount claimed, adjustments for security, retention and previous payments, and the amount claimed (+ GST amounts).

- Progress Claim – shows each schedule item in the Claim with schedule qty, quantity claimed, sell rate and total value.

- Progress Claim Detail – adds columns for previous certified qty and amount, and this claim qty and amount to the progress claim report.

- Claim – Completion – adds columns for to complete qty and amount, and at completion qty and amount to the progress claim report.

- Progress Claim Cover with Completion

Lot Qty

- Lot Qty Report (Val) – Shows each Schedule Item in the Claim and the Lots (by status) which support the claim. Includes the qty and value of each Lot.

- Lot Qty Report (No val) – Shows each Schedule Item in the Claim and the lots (by status) which support the claim. Includes the qty of each Lot only.

Cost vs. Revenue

- Cashflow – a summary of the forecast incoming monies vs outgoing costs for the current period and to date. This reports:

- revenue which is based on the claim’s sell amounts, less any cash security and retention

- costs are calculated from the daycosts register

- free cashflow = revenue – costs

- risk – any overclaim included in the revenue or supplier invoices in dispute

- reconciliations – compares the daycost totals with the invoice totals

- Budget Variance – a summary of the earned budget vs costs for the current period and to date. This reports:

- budget – which is based on the claim’s djc amounts adjusted for overclaim.

- costs are calculated from the daycosts register.

- profit / loss = budget – costs

- reconciliations – compares the daycost totals with the invoice totals.